Investing in stock market indices has been recognized as a method through which wealth can be accumulated. Stock market indices, which represent a collection of stocks from various companies, are often utilized by investors seeking to benefit from broader market movements rather than individual stock performance. Several strategies and principles are generally applied to generate returns through these indices.

The concept of stock market indices is fundamentally grounded in their ability to reflect the performance of a market segment or the market as a whole. Indices such as the S&P 500, Dow Jones Industrial Average, and NASDAQ Composite are commonly referred to. By investing in these indices, investors aim to capture the general movement of the market without the need to select individual stocks.

Diversification is a principle that is frequently employed when investing in stock market indices. Indices typically consist of multiple stocks from different sectors, which reduces the risk associated with investing in a single company. As the performance of individual companies fluctuates, the overall impact on the index is minimized due to its diversified nature. This approach is often preferred by those who seek to mitigate risk while achieving potential returns.

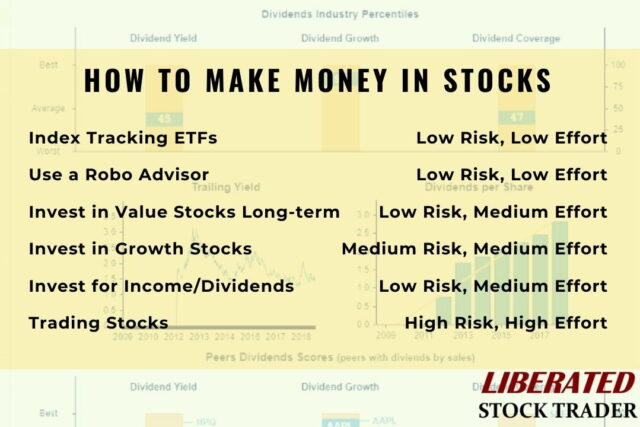

Various methods are used to invest in stock market indices. Exchange-Traded Funds (ETFs) and index mutual funds are two popular vehicles for such investments. ETFs are traded on stock exchanges and their prices fluctuate throughout the trading day, similar to individual stocks. Index mutual funds, on the other hand, are purchased at the end of the trading day at a price determined by the net asset value of the fund. Both ETFs and mutual funds are designed to replicate the performance of specific indices, providing investors with a straightforward means of investing in a broad market segment.

A buy-and-hold strategy is often adopted by investors who are interested in stock market indices. This strategy involves purchasing shares of an index fund and holding them for an extended period, regardless of short-term market fluctuations. The rationale behind this approach is based on the belief that, over time, the market tends to grow and the value of the investment will increase. Historical data supports the notion that long-term investment in stock market indices has generally led to positive returns.

Active management, in contrast, involves frequent buying and selling of index-related assets with the aim of outperforming the market. Although some investors believe that active management can lead to superior returns, evidence suggests that index funds managed passively often perform comparably or better over long periods. Consequently, passive management is often preferred due to its lower costs and simplicity.

The importance of monitoring and adjusting investments is emphasized in the context of stock market indices. Periodic rebalancing of investment portfolios is recommended to ensure alignment with investment goals and risk tolerance. As market conditions change, the performance of various indices may vary, and adjustments may be necessary to maintain an optimal investment strategy.

The concept of compound interest is also relevant when investing in stock market indices. Earnings on investments, including dividends and capital gains, are reinvested to generate additional returns. Over time, the compounding effect can significantly enhance the value of an investment. This principle underscores the benefit of a long-term investment horizon, as the growth potential of an investment is maximized through the reinvestment of earnings.

It is important to recognize the risks associated with investing in stock market indices. While diversification reduces the impact of individual stock performance, market-wide downturns can still affect the value of indices. Economic factors, geopolitical events, and changes in interest rates are examples of variables that can influence market performance. Investors are generally advised to be aware of these risks and to consider their risk tolerance when investing in stock market indices.

Tax implications are another consideration for investors in stock market indices. Capital gains taxes may be incurred on the profits realized from the sale of index fund shares. Additionally, dividend income is typically subject to taxation. It is advisable for investors to be informed about the tax consequences of their investments and to consult with financial professionals to optimize their tax strategies.

Educational resources and financial advisors can be valuable assets for those interested in investing in stock market indices. Various educational materials, including books, articles, and online courses, provide insights into investment strategies and market analysis. Financial advisors can offer personalized guidance based on individual financial goals and risk profiles, helping investors make informed decisions.

Understanding and Trading the S&P 500

The S&P 500, widely recognized as a benchmark for the U.S. stock market, encompasses 500 of the largest companies in the United States. Its significance in financial markets is emphasized by its representation of approximately 80% of the market capitalization of the U.S. equity market. A thorough understanding of the S&P 500 and its trading dynamics is crucial for investors seeking to navigate the complexities of the financial landscape.

Historical Context

The S&P 500 Index was established in 1957 by Standard & Poor’s. It was designed to provide a comprehensive measure of the U.S. stock market’s performance. The index is weighted by market capitalization, meaning that larger companies have a more substantial impact on its movement than smaller companies. Over the decades, the index has become a vital tool for investors and analysts to gauge market trends and economic health.

Structure and Composition

The S&P 500 is comprised of companies from various sectors, including technology, healthcare, financials, and consumer discretionary. This diversification allows the index to reflect a broad spectrum of economic activities. Companies are selected based on several criteria, including market capitalization, liquidity, and sector representation. Adjustments to the index are made periodically to ensure its accuracy and relevance.

Market Behavior and Indicators

The behavior of the S&P 500 is influenced by various factors, including economic data, corporate earnings, and geopolitical events. Indicators such as the Consumer Price Index (CPI), Gross Domestic Product (GDP), and interest rates are monitored closely by market participants. The correlation between the S&P 500 and these indicators helps in assessing market conditions and predicting future movements.

Trading Mechanisms

Trading the S&P 500 can be accomplished through various financial instruments. These include individual stocks of companies within the index, Exchange-Traded Funds (ETFs) that track the index, and index futures. ETFs, such as the SPDR S&P 500 ETF (SPY), offer a convenient way for investors to gain exposure to the entire index without having to purchase each stock individually. Index futures provide a means for traders to speculate on the future direction of the index, leveraging their positions to potentially amplify returns.

Risk Management

Risk management strategies are essential when trading the S&P 500. Due to its broad exposure, the index can experience significant volatility influenced by both domestic and international factors. Diversification within the index helps mitigate risk, but individual investors should also employ tools such as stop-loss orders, position sizing, and portfolio rebalancing to manage potential losses. Additionally, understanding the risk associated with leverage is crucial, as it can magnify both gains and losses.

Analysis and Strategy

Both fundamental and technical analyses are employed to make informed trading decisions regarding the S&P 500. Fundamental analysis involves evaluating the overall economic conditions and financial health of companies within the index. This includes analyzing earnings reports, economic indicators, and industry trends. Technical analysis, on the other hand, focuses on historical price patterns and trading volumes to predict future price movements. Chart patterns, moving averages, and momentum indicators are commonly used tools in this analysis.

Market Sentiment

Market sentiment, or the overall attitude of investors toward the S&P 500, plays a significant role in its price movements. Sentiment can be driven by news, economic reports, and broader market trends. Tools such as sentiment surveys and investor sentiment indexes provide insights into the prevailing mood of the market. Understanding sentiment helps in anticipating potential market reversals or continuations.

Economic Impact

The performance of the S&P 500 is often seen as a barometer for the health of the U.S. economy. When the index rises, it is typically interpreted as a sign of economic growth and investor confidence. Conversely, a declining S&P 500 may indicate economic challenges or declining investor sentiment. Policymakers and economists frequently monitor the index as part of their broader analysis of economic conditions.

Trading Psychology

The psychological aspect of trading cannot be overlooked. Emotional responses, such as fear and greed, can significantly impact trading decisions and outcomes. Discipline and adherence to a well-defined trading plan are essential to avoid common pitfalls associated with emotional trading. Traders are advised to maintain objectivity and avoid impulsive decisions driven by market fluctuations.

Long-Term Investing vs. Short-Term Trading

Different strategies can be employed when trading the S&P 500, depending on the investor’s goals and risk tolerance. Long-term investing involves holding positions over extended periods, aiming to benefit from the overall upward trend of the market. Short-term trading, including day trading and swing trading, focuses on capitalizing on short-term price movements. Each approach has its advantages and challenges, and the choice between them depends on the individual’s investment strategy and market outlook.

Technological Advancements

Technological advancements have transformed the way the S&P 500 is traded. Algorithmic trading and high-frequency trading strategies leverage sophisticated algorithms to execute trades at high speeds and volumes. These technologies can provide competitive advantages but also introduce new risks and complexities. Staying informed about technological developments is important for modern traders.

Regulatory Considerations

Regulatory frameworks govern trading activities and ensure market integrity. Regulations such as the Securities Act and the Investment Company Act provide guidelines for trading practices and protect investors from fraud and manipulation. Compliance with these regulations is crucial for maintaining fair and transparent markets.

Conclusion

Understanding and trading the S&P 500 involves a multifaceted approach that incorporates historical knowledge, market analysis, and strategic planning. The index serves as a critical indicator of market performance and economic health. Through careful analysis and prudent risk management, investors and traders can navigate the complexities of the S&P 500 and make informed decisions. The ongoing evolution of market dynamics and technological advancements underscores the importance of continuous learning and adaptation in trading practices.

The insights provided into the S&P 500’s structure, behavior, and trading mechanisms serve as a foundation for anyone seeking to engage with this prominent market index. As with all investments, a thorough understanding and strategic approach are essential for achieving desired outcomes.

In conclusion, making money with stock market indices involves understanding the principles of diversification, investment strategies, and risk management. Passive investment methods, such as ETFs and index mutual funds, offer a straightforward approach to participating in market growth. While potential returns can be substantial, it is crucial to be aware of the associated risks and to manage investments with a long-term perspective. By leveraging the advantages of stock market indices and employing sound investment practices, individuals can work towards achieving their financial goals.