Income-generating stocks, also known as dividend stocks, have long been recognized as a source of steady revenue for investors. These stocks provide periodic payments to shareholders, typically in the form of dividends. The appeal of these investments lies in their ability to offer regular income while also potentially benefiting from capital appreciation.

Definition and Characteristics

Income-generating stocks are distinguished by their ability to pay dividends. Dividends are portions of a company’s earnings that are distributed to shareholders. These payments are usually made quarterly, although some companies may issue them monthly or annually. The characteristic that sets these stocks apart from others is their reliability in providing consistent income, making them attractive to income-focused investors.

Types of Income-Generating Stocks

Several types of income-generating stocks are recognized. The most common include:

- Blue-Chip Stocks: These stocks belong to well-established companies with a history of stable earnings and reliable dividend payments. They are often leaders in their industry and are considered less risky compared to other types of stocks.

- Dividend Aristocrats: These are companies that have not only paid dividends consistently but have also increased their dividends annually for a significant number of years. They are often seen as reliable income sources due to their commitment to rewarding shareholders.

- Real Estate Investment Trusts (REITs): REITs are known for generating income through rental income and property management. By law, they are required to distribute a substantial portion of their earnings as dividends, making them attractive for those seeking high yields.

- Utility Stocks: Companies in the utility sector, such as those providing electricity, gas, or water, are known for their stable dividend payments. Their services are essential, which often leads to stable and predictable revenue.

- Master Limited Partnerships (MLPs): These entities operate in the energy sector and offer high yields. They are structured to pass income directly to investors, avoiding corporate taxes, which results in higher dividend payments.

Advantages of Income-Generating Stocks

The advantages of investing in income-generating stocks are considerable.

- Steady Income Stream: Regular dividend payments provide a consistent income, which can be particularly beneficial during retirement or periods of economic uncertainty.

- Potential for Capital Appreciation: In addition to dividend income, investors may benefit from the appreciation of stock prices over time, which can enhance overall returns.

- Reinvestment Opportunities: Dividends can be reinvested to purchase additional shares, potentially leading to compounded growth and increasing the value of the investment.

- Lower Volatility: Dividend-paying stocks are often less volatile than non-dividend-paying stocks. The steady income from dividends can help cushion against market downturns, making these stocks a safer investment option.

- Tax Benefits: In some regions, dividends may be taxed at a lower rate than ordinary income, providing tax advantages for investors.

Risks Associated with Income-Generating Stocks

While income-generating stocks offer many benefits, they are not without risks.

- Dividend Cuts: Companies may reduce or eliminate dividend payments during economic downturns or financial difficulties, impacting income for investors.

- Interest Rate Sensitivity: Rising interest rates can make dividend stocks less attractive compared to fixed-income investments like bonds. Higher rates may lead to a decrease in stock prices.

- Inflation Risk: Over time, inflation can erode the purchasing power of dividend income. If dividend growth does not keep pace with inflation, the real value of income may decline.

- Sector-Specific Risks: Certain sectors, such as utilities or REITs, may face unique risks that can impact dividend payments. For instance, regulatory changes or economic conditions affecting real estate can influence REIT performance.

Evaluating Income-Generating Stocks

Investors should conduct thorough research when evaluating income-generating stocks. Key factors to consider include:

- Dividend Yield: The dividend yield is calculated by dividing the annual dividend payment by the stock’s current price. A higher yield may indicate a more attractive income opportunity but should be assessed in conjunction with other factors.

- Dividend History: An analysis of a company’s dividend history, including the consistency and growth of payments, can provide insight into its reliability.

- Financial Health: Assessing a company’s financial stability, including its earnings, debt levels, and cash flow, is crucial. Strong financial health increases the likelihood of continued dividend payments.

- Payout Ratio: The payout ratio is the percentage of earnings paid out as dividends. A high payout ratio may indicate that a company is distributing a significant portion of its earnings, which can be a risk if earnings decline.

- Growth Potential: Evaluating the company’s growth prospects and industry trends can help determine whether the stock will continue to provide attractive income and potential capital appreciation.

Making Money Through Dividends and Distributions

Investing in dividends and distributions can be a strategic approach to generating income. In financial terms, dividends are typically paid out by corporations to their shareholders from profits. Distributions, on the other hand, can refer to payouts from various types of investments, including mutual funds, real estate investment trusts (REITs), and master limited partnerships (MLPs).

Understanding Dividends

Dividends are usually disbursed on a regular basis—quarterly, semi-annually, or annually. The decision to pay dividends is made by a company’s board of directors. The dividend amount is generally expressed as a fixed dollar amount per share or as a percentage of the share price known as the dividend yield.

In the stock market, dividends are often used by investors as a method to earn passive income. The attractiveness of dividend-paying stocks lies in their ability to provide a steady income stream. When dividends are received, they can be reinvested to purchase additional shares, a strategy known as dividend reinvestment. This reinvestment can compound returns over time, potentially increasing the overall wealth of an investor.

Types of Dividends

Dividends can be classified into several types. Cash dividends are the most common, where a cash payment is made directly to shareholders. Stock dividends, however, involve the issuance of additional shares instead of cash. Special dividends are one-time payments made outside the company’s regular dividend schedule and are often a result of extraordinary profits or asset sales.

Understanding Distributions

Distributions are a broader term and can refer to payments made from different types of investment vehicles. Mutual funds, for example, may distribute income earned from their underlying investments to shareholders. These distributions can include dividends, interest income, and capital gains.

Real Estate Investment Trusts (REITs) are another common source of distributions. REITs typically invest in income-producing real estate and are required by law to distribute a significant portion of their taxable income to shareholders. These distributions can be appealing to investors seeking exposure to real estate without owning physical properties.

Master Limited Partnerships (MLPs) also distribute income to investors. MLPs are often involved in energy sectors, such as oil and gas pipelines. These entities benefit from favorable tax treatment, and their income is passed through to investors in the form of distributions, which are generally more predictable than dividends from common stocks.

The Benefits of Dividends and Distributions

The primary advantage of receiving dividends and distributions lies in their potential to provide a consistent income stream. Investors looking for reliable cash flow may find dividend-paying stocks and distributions from various investment vehicles appealing. This income can be used for living expenses, reinvested, or saved for future goals.

Another benefit is the potential for capital appreciation. Companies that pay dividends may also experience stock price growth, offering both income and the possibility of capital gains. When dividends are reinvested, the compounded growth of investments can accelerate over time.

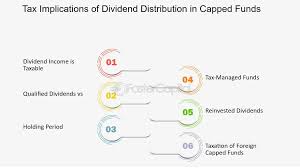

Tax advantages may also be associated with dividends and distributions. Qualified dividends, which meet specific criteria, may be taxed at a lower rate compared to ordinary income. Distributions from certain investment types, like REITs, may also have favorable tax treatment.

Considerations for Investors

Investors should consider several factors when evaluating dividend-paying stocks and distributions. The stability and sustainability of dividend payments should be assessed. Companies with a history of consistent or growing dividends may be viewed as more reliable.

The financial health of the paying entity is crucial. Companies with strong balance sheets and cash flows are more likely to maintain dividend payments. Conversely, companies facing financial difficulties may cut or suspend dividends, potentially impacting the income received by investors.

Diversification is another key consideration. Relying solely on dividend-paying stocks or specific types of distributions can expose investors to sector-specific risks. A diversified portfolio, including a mix of dividend-paying stocks, REITs, and other income-generating investments, can help mitigate risk.

Conclusion

Income-generating stocks play a significant role in the investment landscape by providing steady income and potential for capital appreciation. They are characterized by their ability to pay dividends, and various types, including blue-chip stocks, dividend aristocrats, REITs, utility stocks, and MLPs, cater to different investment needs. While they offer several advantages, such as a steady income stream and lower volatility, they also come with risks, including dividend cuts and interest rate sensitivity. Careful evaluation of factors such as dividend yield, payout ratio, and financial health is essential for investors seeking to maximize returns from income-generating stocks.